Marcos Issues Stern Warning: Pay Your Taxes or Face the Consequences

Marcos to Filipinos: Pay Your Taxes for a Stronger Nation

MARCOS – President Marcos issued a strong warning to the public, urging them to pay their taxes diligently or risk facing serious consequences.

President Ferdinand Marcos Jr. has urged Filipinos to meet their tax responsibilities, stressing that those who evade taxes will face legal consequences. Speaking at the Bureau of Internal Revenue (BIR)’s national tax campaign launch in Pasay, he reassured the public that the government remains dedicated to cracking down on tax evasion to uphold fairness in the system.

Marcos revealed that the BIR collected over P2.85 trillion in taxes in 2024, exceeding the P2.52 trillion collected in 2023. This milestone represents the highest tax revenue in two decades, demonstrating the administration’s intensified efforts to improve tax enforcement and compliance.

Highlighting the importance of these revenues, Marcos noted that the 2024 tax collections could support the construction of 1.14 million new schools, 190,133 kilometers of roads, and 167,014 rural health centers. This reinforces the critical role tax payments play in funding national development, infrastructure, and essential public services.

Efforts to enhance tax collection have resulted in 74,656 new business registrations in 2024, bringing the total number of registered taxpayers to nearly 5.7 million. Additionally, compliance checks on 307,028 establishments led to the recovery of P257.01 million in unpaid taxes, further bolstering government revenues.

Marcos also emphasized the BIR’s digital transformation, citing the introduction of the Online Registration and Update System and the electronic one-time transaction system. These initiatives aim to streamline tax processes, making it easier and more efficient for individuals and businesses to comply with tax regulations.

READ ALSO: President Bongbong Marcos Refuses To Do Hair Follicle Test

According to the report, the government has also intensified its crackdown on fraudulent transactions. The Run After Fake Transactions (RAFT) initiative has led to legal actions against tax fraudsters, recovering P4.33 billion in 2024—a substantial increase from the P617.95 million recovered in 2023.

Additionally, operations against illicit trade, particularly in smuggled cigarettes, vapes, and other taxable goods, generated P110.33 million in additional revenue.

With these ongoing efforts, Marcos reaffirmed his administration’s commitment to strengthening the tax system, ensuring accountability, and maximizing revenues to drive national progress.

News

Gretchen Barretto Breaks Her Silence on Sunshine Cruz and Atong Ang’s Breakup! But What Exactly Did She Reveal? The Truth Is More Twisted Than You Think… (VIDEO) /lo

Are they or aren’t they? Gretchen Barretto and Atong Ang’s relationship rumors heat up anew Gretchen Barretto and Atong…

WATCH NOW: Sanya Lopez Finally Speaks Out, Admitting That the JakBie Breakup Affected Her Deeply, Making Her Life Worse – This Detail Is Even More Shocking, Leaving Readers Stunned and Incredulous! /lo

Sanya Lopez Shares Her Thoughts On Jak Roberto-Barbie Forteza Split Sanya Lopez was affected also by the JakBie breakup Kapuso…

Chenopodium Album (Lamb’s Quarters): Discovering its Nutritional and Medicinal Proficiencies

Lamb’s Quarters, scientifically known as Chenopodium album and alternatively named wild spinach, goosefoot, or pigweed, is a multifunctional herbaceous plant…

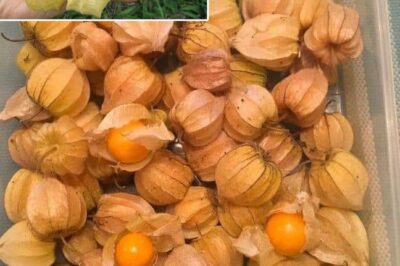

The Remarkable Benefits and Uses of Physalis peruviana (Goldenberry)

Physalis peruviana, known commonly as goldenberry, Cape gooseberry, or Uvilla/Uchuva in parts of South America, is a vibrant, small fruit…

Francine Diaz Struggles with Foot Pain, and Seth Fedelin Comes to the Rescue – What’s the Untold Story After Their Star Magical Prom? /LO

Francine Diaz Nasaktan Ang Paa Kaya Binuhat Ni Seth Fedelin Pagkatapos Ng Star Magical Prom nila! Humakot ng tatlong…

HOT: Raquel Pempengco’s Mother Fires Back at Ogie Diaz – But What’s the Real Reason Behind Her Sudden Outburst? /lo

Ina Ni Raquel Pempengco Agad Na Bumwelta Kay Ogie Diaz! Tila nagkaroon ng lakas ng loob ang ina ni…

End of content

No more pages to load